The current CIT rates are provided in the following table. On the First 5000.

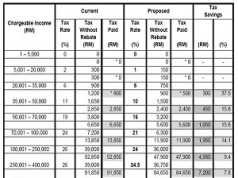

One of the key proposals in this years Budget is the increase in individual income tax rate highest band from 28 percent to 30 percent for resident individuals with chargeable income of more than MYR 2000000.

. Calculations RM Rate TaxRM 0 - 2500. Additionally the tax rate on those earning more than RM2 million per year has been increased from 28 to 30. You just need to be aware of these reliefs and make a point of keeping the receipts when you expend money in these areas.

If taxable you are required to fill in M Form. Malaysia Residents Income Tax Tables in 2019. On the First 10000 Next 10000.

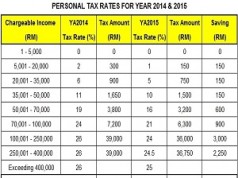

Assessment Year 2019 Individual Taxable Income for the first RM35000 is RM900 and calculate on 10 for the next RM15000 of total income. Based on this table there are a few things that youll have to understand. Increase to 10 from 5 for companies.

The fixed income tax rate for nonresident individuals is also increased to 30 percent. Increase to 10 from 5 for non-citizens and non-permanent residents. The Malaysian 2020 budget raised the maximum tax rate an individual could pay to 30 percent from 28 percent for chargeable income exceeding 2 million ringgit US489 thousand.

14 rows Malaysia Personal Income Tax Rate. The following rates are applicable to resident individual. Friday 10 July 2020 1200.

Tax rates in Malaysia. Increase to 5 from 0 for citizens and permanent residents. On the First 5000.

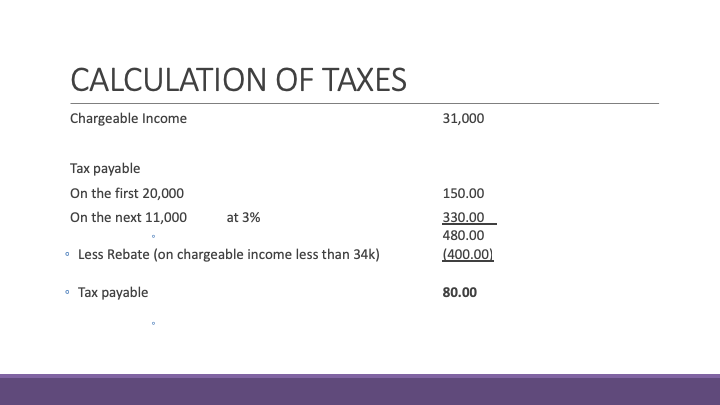

On the First 35000 Next 15000. First of all you have to understand what chargeable income is. Tax RM 0 - 5000.

On the First 5000 Next 5000. Moreover mean income rose at 42 per cent in 2019. In 2019 mean income in Malaysia was RM7901 while Malaysias median income recorded at RM5873.

As a non-resident youre are also not eligible for any tax deductions. You can calculate your taxes based on the formula above and just make sure your total income in the first column comes up to. Tax reliefs and rebates There are 21 tax reliefs available for individual taxpayers to claim.

Corporate - Taxes on corporate income. Income Tax Return for 2 YAs or more RM1000 to RM20000 or imprisonment or both and 300 of tax liability on conviction. A graduated scale of rates of tax is applied to chargeable.

On the First 2500. Or 300 of tax payable in lieu of prosecution 20182019 Malaysian Tax Booklet Income Tax. The deadline for filing income tax in Malaysia is April 30 2019 for manual filing and May 15 2019 via e-Filing.

Malaysia uses both progressive and flat rates for personal income tax depending on an individuals duration and type of work in the country. Last reviewed - 13 June 2022. 20182019 Malaysian Tax Booklet 22 Rates of tax 1.

Non-tax residents will be taxed with the rate of 15 or progressive tax rates whichever results in a higher amount if physically being in Singapore from 61 to 182 days. On the First 20000 Next 15000. In terms of growth median income in Malaysia grew by 39 per cent per year in 2019 as compared to 66 per cent in 2016.

11 rows Malaysia Residents Income Tax Tables in 2019. Tax Rates for Individual Assessment Year 2019. Resident individuals Chargeable income RM YA 20182019 Tax RM on excess 5000 0 1 20000 150 3 35000 600 8 50000 1800 14 70000 4600 21 100000 10900 24 400000 83650 25 600000 133650 26 1000000 237650 28 A qualified person defined who is a knowledge worker residing in Iskandar.

Income Tax Rates and Thresholds Annual. Foreigners with a non-resident status are subjected to a flat taxation rate of 28 this means that the tax percentage will remain the same no matter the amount of income. For both resident and non-resident companies corporate income tax CIT is imposed on income accruing in or derived from Malaysia.

Here are the tax rates for personal income tax in Malaysia for YA 2018. 13 rows Personal income tax rates. Chargeable income MYR CIT rate for year of assessment 20212022.

With the Budget 2019 the RPGT for disposal of real estate from the 6th year of ownership onwards will be increased. Personal income tax in Singapore is based on residency status tax resident and non-tax resident Tax residents are taxed based on a progressive basis from 0 to 22. Income Tax Rates and Thresholds Annual.

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News

Calculating Individual Income Tax On Annual Bonus In China Updates Dezan Shira Associates

Malaysia Personal Income Tax Guide 2020 Ya 2019 Yh Tan Associates Plt

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

Everything You Need To Know About Running Payroll In Malaysia

Cukai Pendapatan How To File Income Tax In Malaysia

Malaysian Bonus Tax Calculations Mypf My

Malaysia Personal Income Tax Rates Table 2011 Tax Updates Budget Business News

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News

Ease Of Doing Business Singapore Vs Malaysia Rikvin Pte Ltd

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

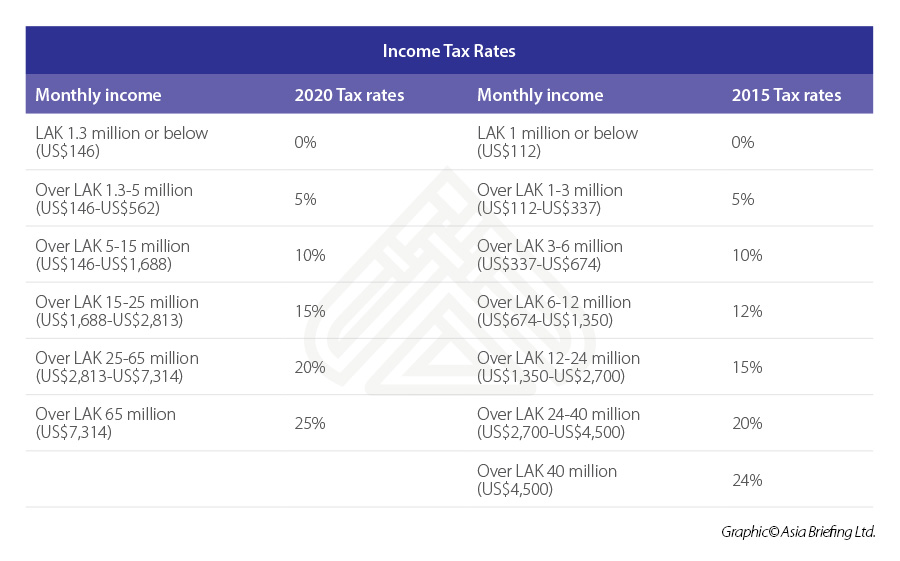

Tax Identification Numbers In Laos Compliance By June 2021

What Bloggers Influencers And Freelancers Need To Know About Taxes In Malaysia Blogjunkie Net

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

Malaysia Personal Income Tax Calculator Malaysia Tax Calculator

Malaysia Personal Income Tax Guide 2020 Ya 2019 Yh Tan Associates Plt

Personal Income Tax E Filing For First Timers In Malaysia Mypf My